Alternatives

The savvy investor’s guide to secondaries

September 20, 2024

Private equity secondaries have long been a tool available to large institutions and ultra-high-net-worth individuals. Now, as innovative solutions like the BMO Carlyle Private Equity Strategies Fund are making the secondary market accessible to a wider range of accredited investors, Chris Perriello, Carlyle’s Global Head of Secondaries, serves as your guide, discussing secondaries’ usage and appeal and sharing a snapshot of the current secondaries landscape.

What are secondaries, and how are they used?

The simplest way to describe secondaries is that they provide liquidity to what is generally an illiquid asset class: private equity. The specific problems they can help solve depend on the type of investor and the current market environment.General partners (GPs) are investment professionals, like Carlyle, who manage private equity funds, while limited partners (LPs) are the investors in those funds. For LPs, the secondary market can: (i) help in managing portfolios to align with allocation targets, (ii) manage liquidity needs, or (iii) create liquidity for a new opportunity. For instance, if markets have been strong, an LP may look to sell part of their position to move from a hypothetical 5% allocation back to their 4% target, or LPs can relieve some of the internal administrative burden associated with managing a portfolio of otherwise illiquid assets. Additionally, the secondary market may enable LPs to raise or redeploy capital to take advantage of new opportunities.GPs use secondaries in a different way. In favourable market conditions, GPs look at the secondary market as a partner. If, for instance, they identify a new opportunity for growth with a particular asset such as a merger or acquisition (M&A) and would like to see it through rather than selling the asset to a strategic investor or another GP, they may instead turn to the secondary market as a partner for another value-creation turn. In less-than-favourable market conditions, which could include economic downturns or sudden shocks like geopolitical crises, the drivers change but the outcomes remain the same. In those cases, GPs may need to manage exit activity at their fund level given the desire of many of their LPs for liquidity; this is where the continuation fund option can be a valuable tool. GPs may also consider the secondary market in cases where other exit opportunities do not appear to be viable—for instance, if the initial public offering (IPO) market is closed, or if strategic investors don’t have the capital to do a stock deal.The bottom line is that while conditions may vary, there are opportunities in secondaries for both LPs and GPs in all market environments.

How has the secondary market grown?

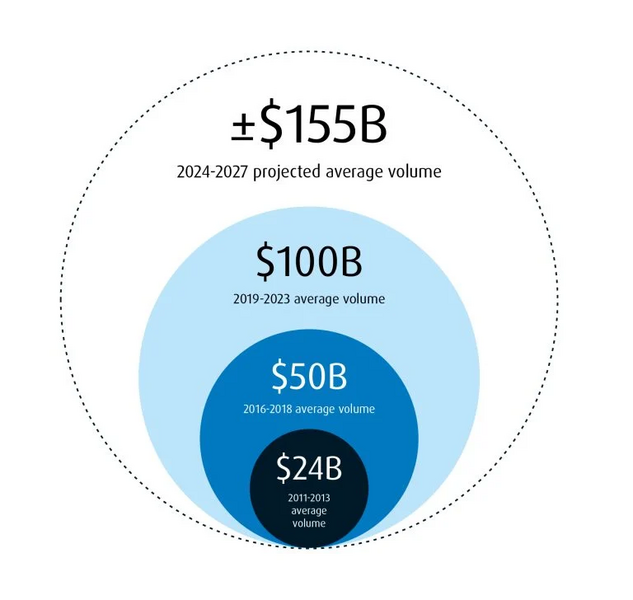

Over the past 25 years, private equity secondaries have grown from a niche market of less than $5 billion in volume to around $120 billion—and this trend shows no signs of slowing down.1

Secondary market growth

Approximately 2x+ growth every 4–5 years1

Two major developments contributed to this explosion. First, in the early 2000s, institutional LPs began to use the secondary market as an active portfolio management tool. Prior to that, secondaries were largely event-driven, meaning that something had to happen in order for an investor to sell their assets. Active portfolio management by institutional LPs took the secondary market from the single-digit billions to around $25–$35 billion in volume by the 2010s, and it continues to be a steady driver of market growth today, accounting for about $60 billion—or roughly half—of total volume.1

The second driver of growth, which has fundamentally changed the size of the secondary market, is GP participation. Between 2000 and 2010, the GP-centred space represented less that 5% of total secondary market volumes. Since 2010, however, GPs have also begun to look to secondaries as a tool for managing fund liquidity. The GP space now accounts for around $60 billion in volume—the other 50% of the secondary market—and is expected to be the biggest growth driver for secondaries going forward. Currently, only 30-40% of GPs currently use the secondary market, meaning there is still a large, untapped universe of GPs that could contribute to further growth.4

Are there benefits to secondaries beyond liquidity?

Yes. Many institutional investors have come to realize that secondaries can serve as attractive core investments in addition to their role as liquidity providers. Given the pace of distributions and the shorter duration profile of the investments, secondaries offer a very efficient use of capital for any LP. Secondaries also typically produce steady and predictable returns,5 as properly diversified secondary funds—like those we manage, which feature approximately 1,500 portfolio companies—tend to perform within a fairly narrow, positive band, with a consistently low loss ratio.

How does the broader environment affect the secondary market?

The secondary market does react to macroeconomic factors like inflation, interest rates, and geopolitics, but on a lag. To explain: Whenever there is a sudden shock to the system, like the Global Financial Crisis (GFC) in 2008-09 or COVID in 2020, some analysts will speculate that the secondary market is going to get hot because of its reputation as a countercyclical space. This assumption isn’t wrong, but it usually takes a little time due to the slower price discovery process in private markets compared to public markets.

In public markets, there is a wealth of information available to investors at virtually all times and all assets are priced on a daily basis. In private markets, however, only GPs have a real-time view of their assets—everyone else is dealing with incomplete information that is often only released on a quarterly basis, with valuations also only being updated on a quarterly basis. As a result, it takes some time—often six to 12 months—for buyers and sellers to get on the same page. For example, the GFC resulted in increased supply in secondary markets, but it took some time for many executable deals to be reached. This resulted in 2010 and 2011 being banner years for the secondary space. Likewise, the post-COVID period of late 2022 and early 2023 was slow from a volume perspective, but the secondary market has had a tremendous run in the 12-plus months since.6

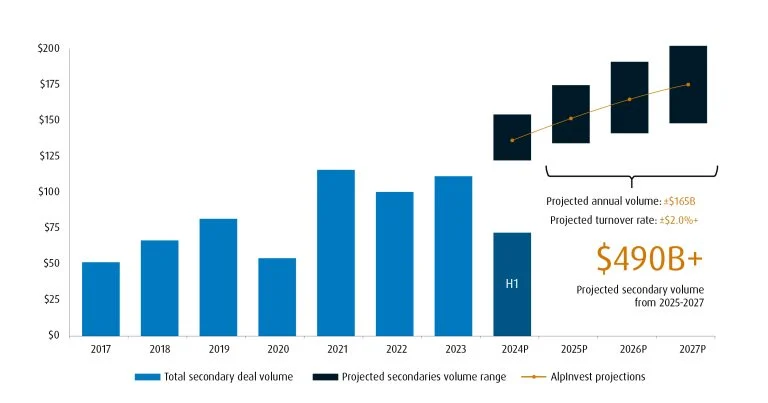

Secondary market volume projections ($ billions)1

What’s happening in the secondaries space now?

As mentioned, the secondary market has picked up tremendously over the past year. Volume-wise, the back half of 2023 saw the market turn, starting with a rebound in LP interest. In terms of bid/ask spreads, the general rule is that when sellers are receiving at least 85 cents on the dollar, they’ll come to the market, but if it’s below 85, volume usually stalls. What we’ve seen is volume picking up every quarter since late 2023 as headline pricing has gotten more attractive for LPs. GP interest lagged behind because the continuation fund market tends to be more sensitive to discounts than LPs, but as the market solidified in the fourth quarter of 2023 and the first quarter of 2024, the GP market also picked up substantially.

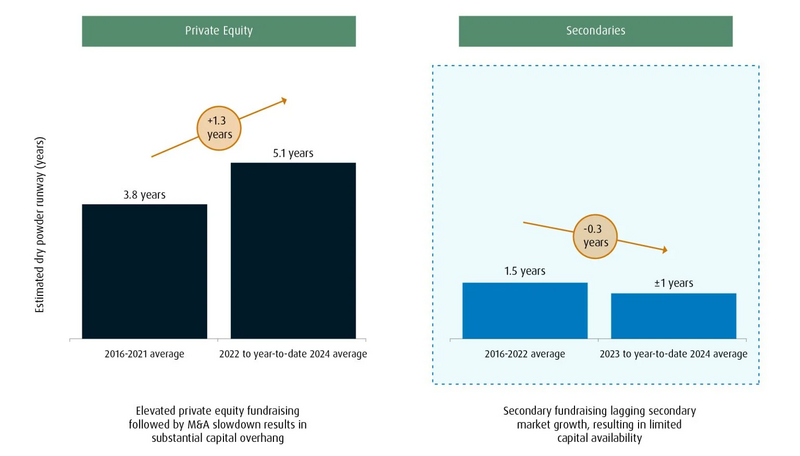

Currently, there is a backlog of supply that is far outpacing the capital formation side—there is only about $120 billion, or a year’s worth of capital, waiting in the hands of buyers.8 In our view, that means we are in a fairly good place from a supply-and-demand perspective: there’s competition without the market being frantic, buyers have an opportunity to pick their spots, and there’s room for negotiation.

Elevated volumes have depleted secondary dry powder levels8

How can accredited investors access secondaries?

Secondaries are the largest component of the BMO Carlyle Private Equity Strategies Fund according to its target asset allocation (35-60% to secondaries, 25-50% to co-investments, and 0-15% to primaries).

From an accredited investor’s perspective, there are many reasons to have a secondaries fund in your portfolio. Alexander Singh, BMO Global Asset Management’s Head of Alternative Partnerships, discusses these benefits in his piece on the BMO Carlyle Private Equity Strategies Fund elsewhere in this issue.

For more information

Contact your Regional BMO Global Asset Management Representative or the BMO GAM Alternatives Team at bmogamalts@bmo.com.

Insights

Sources

1For illustrative purposes only. No assurance that trends depicted will continue. Secondary market volume amounts and composition are AlpInvest (as defined above) estimates for Private Equity secondary volume (excluding real estate and infrastructure) based on (i) AlpInvest deal flow figures, (ii) publicly available news sources (including www.SecondariesInvestor.com and Preqin) and (iii) market data provided from 2016 – July 2024 to AlpInvest by select large secondary market intermediaries which has been aggregated using AlpInvest estimates for relative market share. 2024-2027 projections are AlpInvest estimates based on Preqin historical fundraising and fund development data (accessed in January 2024) as well as AlpInvest projections for future private equity fundraising and secondary market turnover rates. Projections are inherently uncertain and subject to change; actual results may vary.

1For illustrative purposes only. No assurance that trends depicted will continue. Secondary market volume amounts and composition are AlpInvest (as defined above) estimates for Private Equity secondary volume (excluding real estate and infrastructure) based on (i) AlpInvest deal flow figures, (ii) publicly available news sources (including www.SecondariesInvestor.com and Preqin) and (iii) market data provided from 2016 – July 2024 to AlpInvest by select large secondary market intermediaries which has been aggregated using AlpInvest estimates for relative market share. 2024-2027 projections are AlpInvest estimates based on Preqin historical fundraising and fund development data (accessed in January 2024) as well as AlpInvest projections for future private equity fundraising and secondary market turnover rates. Projections are inherently uncertain and subject to change; actual results may vary.

1For illustrative purposes only. No assurance that trends depicted will continue. Secondary market volume amounts and composition are AlpInvest (as defined above) estimates for Private Equity secondary volume (excluding real estate and infrastructure) based on (i) AlpInvest deal flow figures, (ii) publicly available news sources (including www.SecondariesInvestor.com and Preqin) and (iii) market data provided from 2016 – July 2024 to AlpInvest by select large secondary market intermediaries which has been aggregated using AlpInvest estimates for relative market share. 2024-2027 projections are AlpInvest estimates based on Preqin historical fundraising and fund development data (accessed in January 2024) as well as AlpInvest projections for future private equity fundraising and secondary market turnover rates. Projections are inherently uncertain and subject to change; actual results may vary.

4PJT FY2023 Secondary Market Insight Report.

5Secondaries have demonstrated a lower Dispersion of Returns (a measure of the range of outcomes of investments based on historical data) than other private markets strategies. Source: “Navigating Volatile Markets with Secondaries,” Hamilton Lane, November 16, 2022.

6Grant Murgatroyd and Laura Messchendorp, “Fundraising boom as private equity secondaries market heats up,” Preqin News, April 29, 2024.

1For illustrative purposes only. No assurance that trends depicted will continue. Secondary market volume amounts and composition are AlpInvest (as defined above) estimates for Private Equity secondary volume (excluding real estate and infrastructure) based on (i) AlpInvest deal flow figures, (ii) publicly available news sources (including www.SecondariesInvestor.com and Preqin) and (iii) market data provided from 2016 – July 2024 to AlpInvest by select large secondary market intermediaries which has been aggregated using AlpInvest estimates for relative market share. 2024-2027 projections are AlpInvest estimates based on Preqin historical fundraising and fund development data (accessed in January 2024) as well as AlpInvest projections for future private equity fundraising and secondary market turnover rates. Projections are inherently uncertain and subject to change; actual results may vary.

8For illustrative purposes only. Source: AlpInvest analysis. No assurance is given that such trends will continue. 2022-YTD 2024 average reflects average dry powder and LTM volume figures for June 2022, December 2022, June 2023, December 2023, and June 2024. Buyout and Distressed PE dry powder based on data from the Preqin Quarterly Update: Private Equity (July 2024). Buyout investment volume based on Preqin estimated deal volume in 2022-2024YTD (accessed July 2024). Secondaries investment volume and dry powder estimates based on AlpInvest secondary transaction volume estimates (pre-leverage and not including announced fundraises) and Preqin fundraising data.

8For illustrative purposes only. Source: AlpInvest analysis. No assurance is given that such trends will continue. 2022-YTD 2024 average reflects average dry powder and LTM volume figures for June 2022, December 2022, June 2023, December 2023, and June 2024. Buyout and Distressed PE dry powder based on data from the Preqin Quarterly Update: Private Equity (July 2024). Buyout investment volume based on Preqin estimated deal volume in 2022-2024YTD (accessed July 2024). Secondaries investment volume and dry powder estimates based on AlpInvest secondary transaction volume estimates (pre-leverage and not including announced fundraises) and Preqin fundraising data.

Disclaimers

For Advisors and Institutional Client Use Only

“BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.

BMO Global Asset Management (BMO GAM) is a brand name under which BMO Asset Management Inc. and BMO Investments Inc. operate. Certain of the products and services offered under the brand name, BMO Global Asset Management, are designed specifically for various categories of investors in Canada and may not be available to all investors. Products and services are only offered to investors in Canada in accordance with applicable laws and regulatory requirements.

The information contained herein: (1) is confidential and proprietary; (2) may not be reproduced or distributed without the prior written consent of BMO GAM; and (3) has been obtained from third party sources believed to be reliable but which have not been independently verified. BMO GAM and its affiliates do not accept any responsibility for any loss or damage that results from the use of this information. This article has been prepared solely for information purposes by BMO GAM.

The information provided herein does not constitute a solicitation of an offer to buy, or an offer to sell securities nor should the information be relied upon as investment advice. Past performance is no guarantee of future results.

Certain statements included in this material constitute forward-looking statements, including, but not limited to, those identified by the expressions “expect”, “intend”, “will” and similar expressions. The forward-looking statements are not historical facts but reflect BMO GAM’s current expectations regarding future results or events. These forward-looking statements are subject to a number of risks and uncertainties that could cause actual results or events to differ materially from current expectations. Although BMO GAM believes that the assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and, accordingly, readers are cautioned not to place undue reliance on such statements due to the inherent uncertainty therein. BMO GAM undertakes no obligation to update publicly or otherwise revise any forward-looking statement or information whether as a result of new information, future events or other such factors which affect this information, except as required by law.

This article is provided to you on the understanding that you will understand and accept its inherent limitations, you will not rely on it in making or recommending any investment decision with respect to any securities that may be issued. An investment in the BMO Carlyle Private Equity Strategies Fund, a trust established under the laws of the Province of Ontario (the “Fund”) described hereby is speculative. A subscription for units of the Fund should be considered only by persons financially able to maintain their investment and who can bear the risk of loss associated with an investment in the Fund. Prospective investors should consult with their own independent professional legal, tax, investment and financial advisors before purchasing units of the Fund in order to determine the appropriateness of this investment in relation to their financial and investment objectives and in relation to the tax consequences of any such investment. Prospective investors should consider the risks described in the confidential offering memorandum (OM) of the Fund before purchasing units of the Fund. Any or all of these risks, or other as yet unidentified risks, may have a material adverse effect on the Fund’s business and/or the return to investors. See “Investment Objective, Investment Strategy and Certain Risks” in the OM of the Fund. In addition to the risks described in the OM of the Fund, the Fund will bear certain risks associated with investment into strategies run by Carlyle AlpInvest (meaning the Carlyle Group Inc., together with its affiliates, also referred to as the “Carlyle Group” or “Carlyle” in this presentation), i.e., the strategies explored by Carlyle AlpInvest through Carlyle AlpInvest Private Markets Sub-Fund –I, a sub-fund of Carlyle AlpInvest Private Markets SICAV –UCI Part II, multi-compartment investment company with variable capital (société d’investissement à capital variable) established as a public limited liability company (société anonyme) in accordance with the law of 10 August 1915 on commercial companies and registered under Part II of the Luxembourg Law of 17 December 2010 relating to undertakings for collective investment (the “Master Fund”, the alternative investment fund manager of the Master Fund being AlpInvest Partners B.V., or “AlpInvest”) in proportion to the amount of the Fund’s investment in the Master Fund. Prospective investors in the Fund should therefore carefully consider the risks described under “Certain Risk Factors and Potential Conflicts of Interest” in the prospectus of the Master Fund. Units of the Fund can only be offered to Canadian accredited investors.